Wei!! Wat about Malaysia? Isn't it IMPORTANT ?

The bosses in this country say it's the center of the universe. It is the most attractive country in the world. To do business here, one would have to compromise. Have to comply to this policy, that contract and 1001 other things.

The bosses in this country say it's the center of the universe. It is the most attractive country in the world. To do business here, one would have to compromise. Have to comply to this policy, that contract and 1001 other things.

You can't afford to take it off your radar screen . You're gonna lose out Ben!

--------------------------------------

Fed Opens Swaps With South Korea, Brazil, Mexico, Singapore

By Steve Matthews and William Sim

Oct. 30 (Bloomberg) -- The Federal Reserve agreed to provide $30 billion each to the central banks of Brazil, Mexico, South Korea and Singapore, expanding its effort to unfreeze money markets to emerging nations for the first time.

The Fed set up ``liquidity swap facilities with the central banks of these four large systemically important economies'' effective until April 30, the central bank said yesterday in a statement. The arrangements aim ``to mitigate the spread of difficulties in obtaining U.S. dollar funding.''

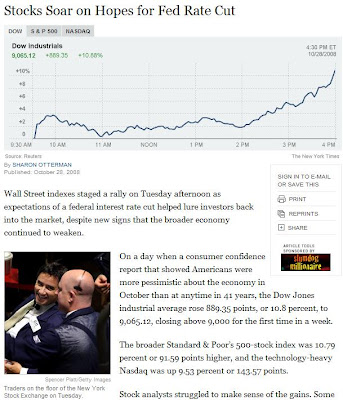

Fed Chairman Ben S. Bernanke is trying to prevent the global credit crisis from upending the financial markets and economies of developing countries, where currencies have plunged and government bond premiums have soared. The Fed yesterday cut its benchmark interest rate, followed by Hong Kong and Taiwan today.

``We can't leave these other important countries out in the cold,'' said Edwin Truman, a senior fellow at the Peterson Institute for International Economics in Washington and former chief of the Fed's international-finance division. ``A global recession is being caused by the effects of seizing up of the financial system around the world.'' ...

(full story at bloomberg.com)

--------------------------------------

Fed Opens Swaps With South Korea, Brazil, Mexico, Singapore

By Steve Matthews and William Sim

Oct. 30 (Bloomberg) -- The Federal Reserve agreed to provide $30 billion each to the central banks of Brazil, Mexico, South Korea and Singapore, expanding its effort to unfreeze money markets to emerging nations for the first time.

The Fed set up ``liquidity swap facilities with the central banks of these four large systemically important economies'' effective until April 30, the central bank said yesterday in a statement. The arrangements aim ``to mitigate the spread of difficulties in obtaining U.S. dollar funding.''

Fed Chairman Ben S. Bernanke is trying to prevent the global credit crisis from upending the financial markets and economies of developing countries, where currencies have plunged and government bond premiums have soared. The Fed yesterday cut its benchmark interest rate, followed by Hong Kong and Taiwan today.

``We can't leave these other important countries out in the cold,'' said Edwin Truman, a senior fellow at the Peterson Institute for International Economics in Washington and former chief of the Fed's international-finance division. ``A global recession is being caused by the effects of seizing up of the financial system around the world.'' ...

(full story at bloomberg.com)

==========================